Budgeting

The right approach to budgeting

Introduction to Budgeting - Planning for success

Welcome to the Right Approach to Budgeting. This guide has been prepared to help you understand the importance of the budgeting process in achieving the financial goals in your business. This guide provides you with the step by step instructions and the templates needed to prepare a budget for your business.

This guide contains:

Section 1 - Some common questions

Section 2 - The golden rules of budgeting

Section 3 - The budgeting process

Section 4 - The budgeting cycle

Section 5 - Budgeting checklist

Section 1

Some common questions

The easiest way to commit to achieving your goals is to write them down. The easiest way to avoid achieving your budget is not to prepare one.

Budgeting is a critical part of the business process. Each business, no matter how large or small, should prepare a budget for the financial year and review it regularly. This ensures that you are committed to achieving your goal in a disciplined way.

So what is a budget?

A budget is a forecast of the sources of cash into your business and the cash expenditures you need to make to run your business. It represents the benchmark against which performance is measured and is the spelling out of the business' plan to realise its competitive advantage.

in other words, a budget is a planned goal.

Why do it?

Simply because it is a way for you to increase your likelihood of success by helping you work out your future cash needs and to plan for profits, spending and the inevitable peaks and troughs of cash flow. A budget is an estimate of your most likely future position based on information that we have today.

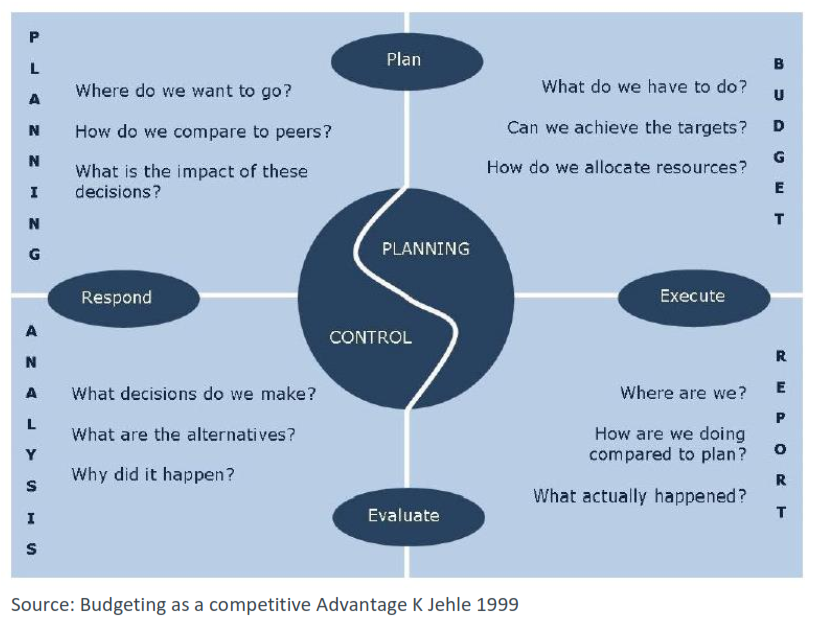

Successful companies see budgeting as the key to their management planning process. The figure below illustrates how initiatives, plans and budgets are interlinked to deliver results.