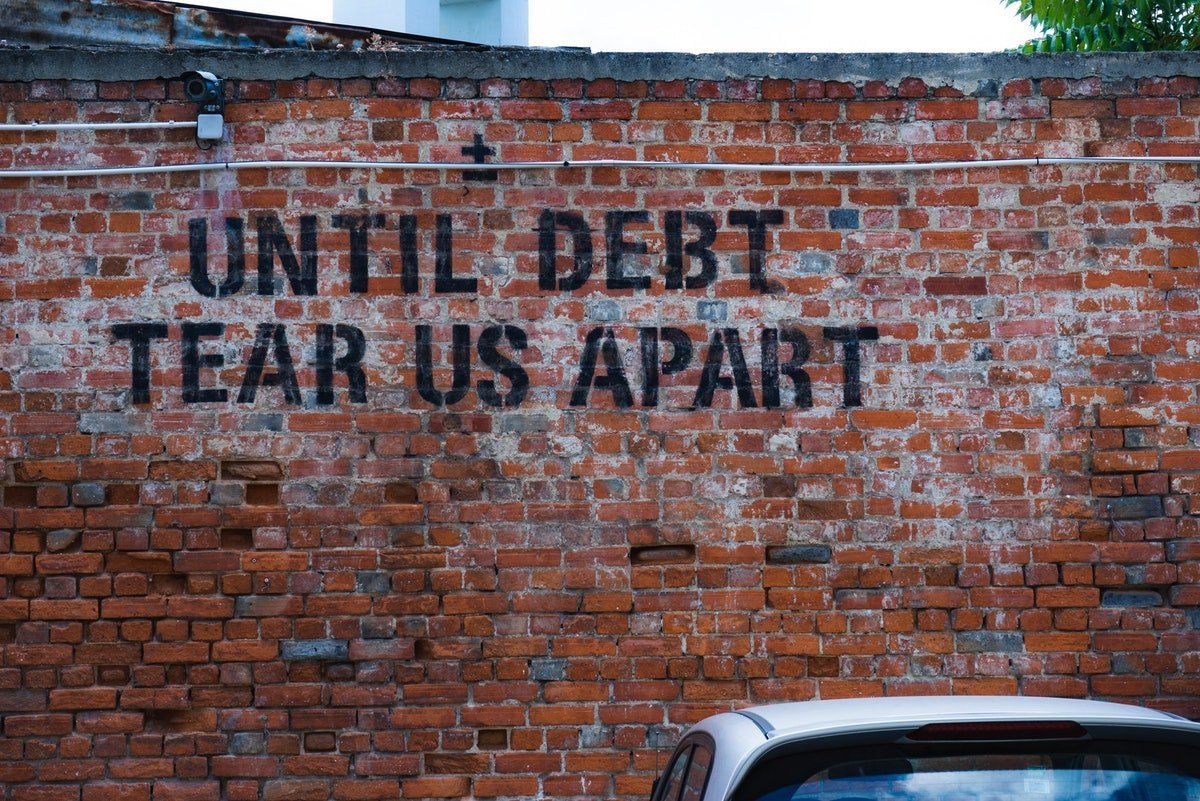

Collect your debtors fast

Collect your debtors fast

Did you know that you still have to pay tax on your debtors, even if you haven't collected them?

This is because you pay tax on your sales figures, whether you have collected the cash or not.

So, how do you collect your debtors faster?

- Agree your payment terms at the time of sale.

- Ensure your customer signs your Terms of Trade before you start the job.

- Include a guarantee in your payment terms.

- Invoice as quickly as you can.

- Ask for a deposit prior to starting the job.

- Change your payment terms to within 7 days of invoice or on delivery.

- Send statements with only two columns - current and OVERDUE.

- Follow up the day after the due date.

- Have someone other than the owner be responsible for collection of debtors (owners are usually too soft!.)

- Document any changes to your standard payment terms in writing.

- Use a debt collector sooner rather than later - the longer you leave it, the harder it is to collect.

- Don't provide credit to customers who have been late payers in the past, and don't offer more credit to customers with outstanding payments.

Don't procrastinate on your debtors. Establish clear payment terms and ensure you stick to them.

It's the squeaky wheel that gets the oil". - Anon

Need help developing your Debtor Management Policy? We can help!