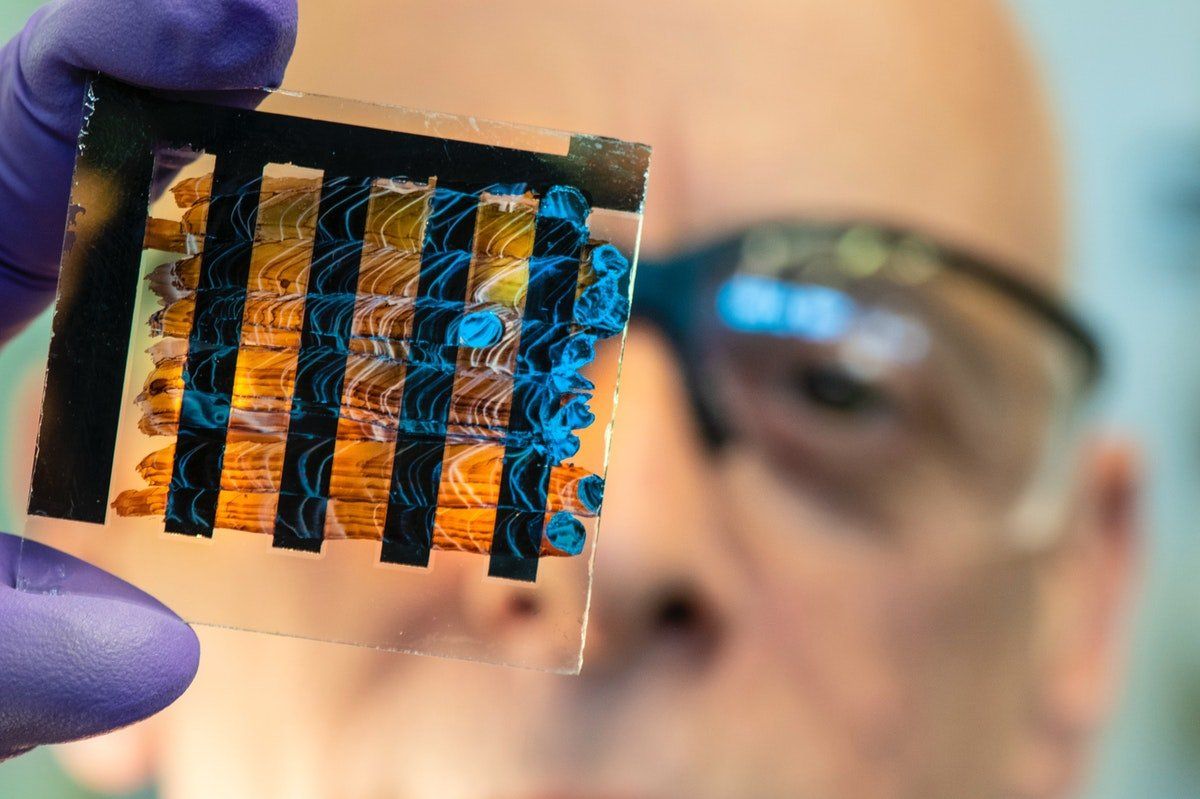

R and D tax incentive for Australian Businesses

R&D tax incentive for Australian businesses

The Australian Government's R&D tax incentive provides targeted offsets that aim to encourage more companies to engage in R&D, in order to contribute to a stronger economy.

The incentive is designed to encourage research and development activities that companies may not otherwise do due to uncertain returns and risk.

What's involved?

The R&DTI offers two levels of tax offset depending on your aggregated turnover:

- a 43.5% refundable tax offset for eligible companies whose annual aggregated turnover is less than $20 million.

- a 38.5% non-refundable tax offset to eligible companies whose annual aggregated turnover is more than $20 million. (entities may be able to carry forward unused offset amounts to future income years).

Who is eligible?

The R&D Tax Incentive is a self-assessment program.